If you’ve bought or sold property, you may have heard this line from a title company: “Just send us any old survey.” At first, it sounds convenient. Why spend money on a new one when you already have a copy in your files? But here’s the problem—many closings stall or even fall apart because that “old survey” doesn’t meet the requirements of the lender or the title insurer. That’s where a fresh ALTA Land Title Survey comes in.

The “Any Old Survey” Myth

On Reddit and other forums, buyers and sellers keep sharing the same frustration: they thought a prior survey would be enough, only to be told—often at the last minute—that it wasn’t acceptable.

Why? Because surveys are snapshots in time. An old boundary sketch from ten years ago might show the property lines, but it won’t capture a new fence, an added shed, or a utility easement recorded later. Title companies and lenders want confirmation of today’s conditions, not what the property looked like years back.

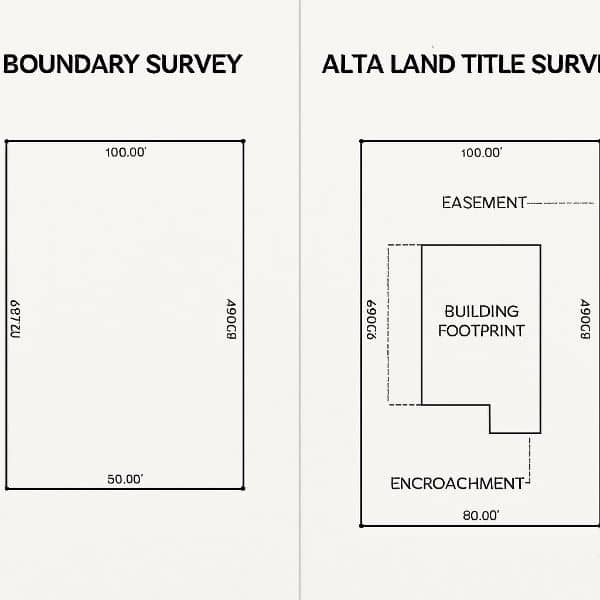

This is where the confusion starts. To most people, a survey is a survey. But in real estate closings, there’s a difference between a simple boundary survey and an ALTA Land Title Survey.

What an ALTA Land Title Survey Really Is

The ALTA Land Title Survey is not just another map of the property. It’s the gold standard for lenders and title insurers. It follows strict national guidelines set by the American Land Title Association (ALTA) and the National Society of Professional Surveyors (NSPS).

What makes it different? An ALTA survey combines fieldwork with a deep dive into title records. It identifies property lines, improvements, easements, encroachments, and access points. On top of that, optional “Table A” items allow clients to request extra details, like square footage of buildings, flood zone data, or utility locations.

Lenders rely on this survey to ensure the property is free of hidden risks. Title companies use it to issue insurance with confidence. Without it, closings can be delayed or denied.

Real-World Frustrations Buyers Face

The stories online aren’t just complaints—they highlight real financial risks. Let’s look at a few common examples.

- Outdated surveys rejected at closing: A seller provided a survey from 2010. The lender refused it because the neighborhood had new easements added in 2015. The deal was delayed, and the buyer had to pay for a rush order on a new survey.

- Encroachment surprises: A buyer discovered after closing that the neighbor’s fence sat three feet over the line. The old survey never showed it. The dispute turned into a legal fight with the HOA.

- Square footage confusion: A property listed as 5,000 square feet turned out to be smaller when measured under current standards. Because the survey wasn’t current, the appraisal and loan documents had to be adjusted, creating last-minute stress.

These frustrations show why relying on “any old survey” is risky in Orlando’s fast-changing market.

Why Buyers and Sellers Need Fresh Surveys

Orlando is not a static city. Neighborhoods keep growing, and land use changes fast. That means a survey that was accurate years ago may no longer reflect reality today.

Here are a few local factors that make a fresh ALTA Land Title Survey important:

- HOA rules and enforcement: Many subdivisions in Orange County have strict setback and fence requirements. A new survey can confirm compliance.

- Utility easements: Stormwater and drainage easements are common. They may be recorded after your last survey.

- Tight lots in infill areas: Even small encroachments matter when homes sit close together. A shed, driveway, or patio can cross a line without anyone noticing.

- Title company expectations: In many closings, title insurers simply won’t accept anything less than an ALTA survey, especially for commercial or high-value residential properties.

ALTA Survey vs. Boundary Survey

So, what’s the real difference?

- Boundary survey: Shows property lines and existing monuments. It’s basic and often cheaper.

- ALTA Land Title Survey: Includes everything a boundary survey has, plus detailed title research, easements, encroachments, and optional data through Table A.

For a casual fence repair, a boundary survey might work. But for a mortgage closing, refinancing, or commercial property deal, the ALTA survey is almost always required.

How to Avoid Closing Delays

The good news? Most of these headaches are preventable if you take action early.

- Ask your lender or title company upfront: Do they require an ALTA survey? Get the answer before you sign contracts.

- If structures are close to property lines: Request corner staking so you can physically see the boundaries. This avoids encroachment disputes.

- Review public records: In Orange County, you can check plats and easements through the Comptroller’s office.

- Order the survey early: Don’t wait until the week of closing. Surveyors often have backlogs, especially in busy seasons.

By handling this early, you save yourself the stress of last-minute rush orders and extra costs.

Can You Ever Reuse an Old Survey?

There are rare cases where a prior survey might work. If it’s less than a year old, no improvements were added, and the surveyor is willing to update the certification, lenders sometimes accept it. But that’s the exception, not the rule. Most of the time, ordering a fresh ALTA Land Title Survey is the safer path.

Final Thoughts

Buying or selling property is stressful enough without last-minute survey problems. While it may sound easier to hand over “any old survey,” the reality is that lenders and title insurers need current, detailed information. An ALTA Land Title Survey provides that assurance.

So, if you’re heading into a closing, don’t gamble with outdated documents. Ask early, plan ahead, and get the right survey for your deal. It’s the simplest way to keep your transaction moving forward and protect yourself from costly surprises.